HISTORICALLY OVEREXTENDED

For anyone who followed the previous blog, you're familiar with the concept of 'Market Variance.' It's used to describe situations where price actions have moved away from a trailing average in a significant way.

https://bluehorseshoefinance.blogspot.com/2018/11/market-data-analytics-variance-revisited.html

Typically, my writing has focused on one day candle charts but a market variance of historic proportions has emerged in the Nasdaq monthly chart that is certainly worth taking note of.

Here's a historical Nasdaq 100 chart with monthly candles:

The blue line in the chart represents the 20 period simple moving average (will now be referred to as the 20 SMA). As of this writing, the 20 SMA is at 8927 while the Nasdaq current price is 11665... a huge nominal difference to say the least.

The technical indicator previously cited, Market Variance, was built to quantify the extent to which a price varies from some appreciable mean relative to historical dispersions.

For the record, I fully realize this is not the technical definition of 'variance', but rather an appropriation made for illustration.

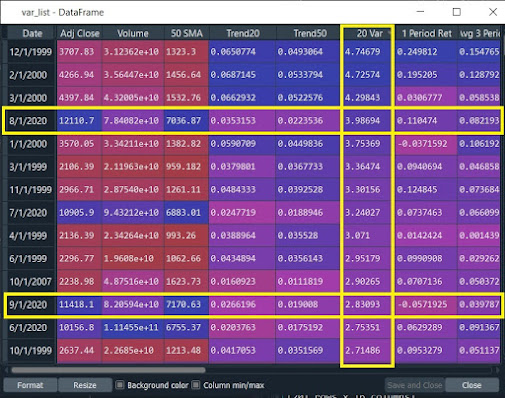

At the end of September, the Nasdaq's monthly candle 'variance' to the 20 SMA was 2.83. For context, the fourth quartile variance for the Nasdaq monthly candle data set is 1.792.

For all instances where the adjusted closing price is above the 50 SMA, September's historical variance of 2.83 is inside the 90th percentile for the data set which dates back to 1993.

WHY THIS MATTERS

To illustrate why this matters, let's consider a common automated trading strategy, the Mean Reversion. Typically, mean reverting algorithms use Bollinger Bands to determine when a market is overbought or oversold.

Going back to the monthly bar chart, we see the NDX is currently well outside of its 2 upside standard deviation band and is challenging the limits of its 3 upside standard deviation band...

...this pattern was repeated in late 1999/early 2000 and October, 2007. These same time periods also happen to show up on our historical rankings of the 'Variance' statistic.

One can only assume that every mean reversion algorithm trading the monthly Nasdaq 100 is flashing a huge giant red sell signal right now.

Comments

Post a Comment